Key Highlights of the Report:

- Around 11% of people (800 million) people suffer from mental disorder globally. After COVID-19 pandemic such as anxiety, depression, and post-traumatic stress problems have risen. The demand for digital solutions for assessment, prevention, support, and treatment of mental health problems has surged in recent years.

- More than 1.5 million people have downloaded the app “Calm Harm” across 171 countries. In total, more than 380,000 health apps are available through Apple and Android operating systems, and around 20,000 are of mental health. Another mental health apps is Headspace, founded in 2010 which has approx reach of 65 million people in 190 countries and has 20 per cent rise in downloads since mid-March.

- The Global Governance Toolkit for Digital Mental Health: Building Trust in Disruptive Technology for Mental Health, launched in 2021 by the World Economic Forum and Deloitte, provides governments, regulators and companies with the tools to protect personal data, ensure high quality of service and address safety concerns with the rise in digital and behavioural mental healthcare.

- Significant factors driving mental health apps market growth are increasing use of smartphones, improvements in coverage networks, and the increasing use of the internet and social media.

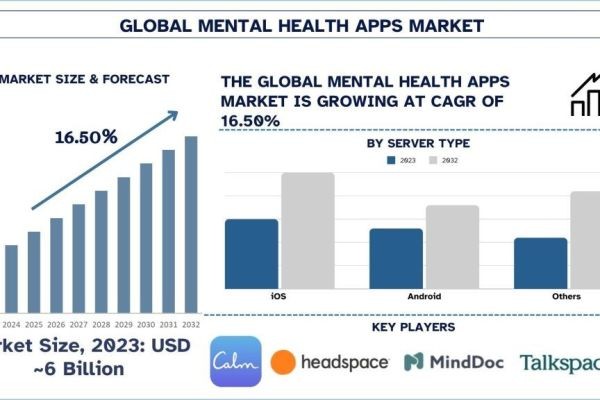

According to a new report by Univdatos, Mental health apps Market in India, is expected to reach USD 8157.96 Million in 2030 by growing at a CAGR of 24.8%. Mental health apps are mobile apps which are designed to help users improving emotional well-being, improving sleep, becoming more mindful and stress free. Some mental health apps allow users to access online talk therapy or psychiatric care while others meditation practice, stress and anxieties, or for improving sleep. These apps are available for iOS and/or Android users, and can be used via smartphone or tablet.

The report suggests that the “Rising number of downloads of mental health apps” is one of the major factors driving the mental health apps market during the forthcoming years. Smartphone adoption has increased in every age group people but it has soared among youth individuals. It is estimated that more than 5 billion people have mobile devices, and more than half are smartphones. In advanced economies people are using more smartphones and prone to internet connections and are using social sites. According to WARC, around 2 billion people currently access the internet via only their smartphone, which equates to 51 percent of the global base of 3.9 mobile users. As of February 2024, people using mobile devices contribute to 59.43% of all website traffic. Mobile computing has drastically changed the technology trends of the 21st century. Africa has the highest proportion of internet traffic coming from mobile devices (69. 13%).While, Internet users are continuously growing, as observable with the latest data indicating that the world’s internet connected population grew by 97million users in the 12 months to January 2024.

Apart from this, reduced stigma, advancements in technology, covid 19 pandemic, innovation by startups,integration into care, better lifestyles, rapid urbanization also positively impact the market’s growth. According to Internet World Stats, as of Q1 2021, global penetration of internet was around 65.6%. A wide range of investments have adopted strategic alliances in this area, thus suggesting huge potential in this area. Some of the recent strategic alliances are:

- In October 2022, Sanvello Health, a leading mental health app was acquired by Better Help which is the world’s largest therapy platform.

- In January 2022, Revery was acquired by Omada Health, a digital care provider which focuses on chronic conditions. Omada aims to integrate emotional health into its whole health platform with the acquisition.

- In 2021, meditation app Calm acquired mental health app Atleta. Calm plans to incorporate Atleta’s mental fitness programs and team collaborations into its products.

- In 2021, online therapy platform Talkspace announced a collaboration with Snapchat to offer Snapchat users free access to Talkspace’s mental health services.

- In 2020, meditation app Headspace and mental health app Ginger merged to form Headspace Health.

iOS Sector Gaining Maximum Traction in Market

By platform type, In 2021 ios gained highest revenue and because of the consumer’s acceptance ios segment is showing escalation in the growth. In U.K market share of ios went from 47% (Q3 2020) to 51.6 % (Q3 2021) according to the data released by Business of Apps in 2021. As of, Apple iphone’s revenue increased from 378 USD Millions (Q2 2008) to 43805 USD Millions (Q4 2023). From the above stats, it’s been evident that ios segment will show rocketed growth from 2024 to 2030. Apple claimed a 24.7 percent share of the market in the fourth quarter of 2023, an increase from the previous quarter. In the first quarter of its 2024 fiscal year. In the first quarter of 2024.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/mental-health-apps-market?popup=report-enquiry

Conclusion

Mental health apps represent an emerging digital health sector with immense potential to transform mental healthcare delivery. Our research indicates significant growth in recent years driven by consumer demand, reduced stigma, covid19 pandemic, innovation by startups, integration into care, better lifestyles, rapid urbanization, technological advancements etc. Improved oversight and FDA regulation is required to uphold quality standards, efficacy claims, and data ethics. As the market matures, issues like sustainability, privacy, overuse risks, and equitable access will need addressing through multistakeholder efforts. Overall our analysis suggests mental health apps can play an esteemed role in expanding access and providing therapeutic support for mental well-being. But more research advancements and clinical trials are required for apps to impart their immense public health potential in an ethical, clinically validated way. It has propitious future but achieving the highest standards of quality, efficacy and safety should remain the top priority as the digital healthcare sector evolves.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2023−2030

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Operating Systems, Payment Mode, and Application

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - https://univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany