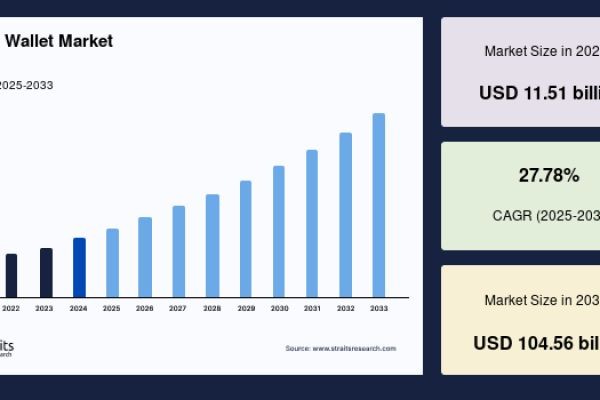

New York, United States – Straits Research, a leading provider of business intelligence, analytics, and advisory services, has released its latest comprehensive Mobile Wallet Market Report Size, highlighting unprecedented growth potential fueled by the rapid digitalization of financial services, rising smartphone adoption, and increasing preference for cashless transactions worldwide. According to the report, the global mobile wallet market size is valued at USD 11.51 billion in 2024 and is projected to reach USD 104.56 billion by 2033, growing at a remarkable CAGR of 27.78% from 2025 to 2033.

The mobile wallet ecosystem has evolved into a core component of modern payment infrastructure, enabling consumers and businesses to conduct secure, fast, and convenient transactions. The market’s expansion is supported by technological advancements, regulatory encouragement of digital payments, and the growing integration of mobile wallets into everyday financial activities.

Mobile Wallet Market Definition

A mobile wallet is a digital application that enables users to store payment information securely on mobile devices and perform financial transactions electronically. These wallets support a wide range of services, including peer-to-peer transfers, bill payments, online and in-store purchases, ticketing, and loyalty programs. Mobile wallets leverage technologies such as near-field communication (NFC), QR codes, cloud-based platforms, and biometric authentication to enhance transaction security and user experience.

By eliminating the need for physical cash and cards, mobile wallets play a vital role in advancing financial inclusion, streamlining payment processes, and reducing transaction costs across multiple sectors.

Mobile Wallet Market Latest Trends

The mobile wallet market is undergoing rapid transformation, shaped by several notable trends. One of the most prominent trends is the growing adoption of contactless payments, particularly NFC- and QR-based solutions, driven by consumer demand for speed and hygiene. Additionally, integration of mobile wallets with e-commerce platforms, ride-hailing services, and subscription-based digital services is expanding wallet utility beyond basic payments.

Another key trend is the emergence of crypto wallets and blockchain-enabled payment solutions, enabling secure storage and transfer of digital assets. Furthermore, biometric authentication, including fingerprint and facial recognition, is increasingly being adopted to enhance security and reduce fraud. The rise of super apps, particularly in Asia-Pacific, is also transforming the market by combining payments, banking, shopping, and lifestyle services into a single platform.

Mobile Wallet Market Insights and Growth Outlook

The market’s rapid growth is supported by increasing internet penetration, favorable government initiatives promoting digital payments, and the expansion of fintech ecosystems. Merchants across retail, transportation, hospitality, and utilities are increasingly accepting mobile wallet payments to improve customer convenience and operational efficiency. As digital-native consumers continue to prioritize seamless payment experiences, mobile wallets are becoming an integral part of global commerce.

Request Sample @

https://straitsresearch.com/report/mobile-wallet-market/request-sample

Key Opportunity in the Mobile Wallet Market

Significant growth opportunities exist in emerging economies, where large unbanked and underbanked populations are adopting mobile wallets as an alternative to traditional banking. Government-led digital payment initiatives, combined with low-cost smartphones and expanding mobile internet access, are accelerating adoption in regions such as Asia-Pacific, Latin America, and Africa.

Additionally, opportunities are emerging through IoT-enabled wallets, integration with smart devices, and cross-border payment solutions, allowing wallet providers to expand their service offerings and revenue streams. Partnerships between banks, fintech firms, telecom operators, and retailers are expected to further unlock market potential.

List of Key Players in the Mobile Wallet Market

The global mobile wallet market is highly competitive, with major technology companies, financial institutions, and telecom operators driving innovation and adoption.

- Apple Inc.

- Alipay

- American Express Company

- Bharti Airtel Limited

- PayPal Holdings Inc.

- Google Inc.

- Samsung Electronics Co. Ltd

- VISA Inc.

- Square Inc.

- Mastercard

- AT&T

- Amazon Pay

These companies are focusing on product innovation, geographic expansion, strategic partnerships, and enhanced security features to strengthen their market presence.

Mobile Wallet Market Segmentations

The Mobile Wallet Market is segmented based on wallet type, payment mode, and application to provide a comprehensive view of market dynamics.

- By Wallet Type

- Closed Wallets

- Semi-Closed Wallets

- Open Wallets

- Crypto Wallets

- IoT Wallets

Closed and semi-closed wallets dominate due to widespread adoption in retail and e-commerce, while crypto and IoT wallets are emerging as high-growth segments.

- By Payment Mode

- NFC

- Remote Payment

- Text-based/Short Message Services

- QR Code

- Digital Only

QR code and NFC-based payments are experiencing strong growth due to ease of use, low infrastructure requirements, and high transaction speed.

- By Application

- Mobile Commerce

- Mobile Transfers

- Micropayments

- Others

Mobile commerce remains the leading application segment, supported by the rapid expansion of online shopping and app-based services.

Get Detailed Segmentation @

https://straitsresearch.com/report/mobile-wallet-market/segmentation

Mobile Wallet Market Geographic Analysis

Asia-Pacific dominates the global mobile wallet market, driven by high smartphone penetration, strong fintech ecosystems, and government-backed digital payment initiatives in countries such as China and India. North America follows, supported by widespread adoption of contactless payments and the presence of leading technology and financial service providers. Europe is witnessing steady growth due to regulatory support for digital payments and increasing consumer preference for cashless transactions.

Mobile Wallet Market Data Insights

Data insights indicate a sharp rise in transaction volumes, increasing merchant acceptance rates, and growing consumer trust in digital payment platforms. The integration of value-added services such as loyalty rewards, buy-now-pay-later (BNPL), and embedded finance is further enhancing wallet adoption and usage frequency.

Future Outlook

The Mobile Wallet Market is expected to continue its exponential growth trajectory as digital payments become central to global economic activity. Technological advancements, expanding use cases, and supportive regulatory frameworks will play a pivotal role in shaping the future of mobile wallets.

Have Any Query? Ask Our Experts @

https://straitsresearch.com/buy-now/mobile-wallet-market

Company Details

Straits Research

Straits Research is a top provider of business intelligence, specializing in research, analytics, and advisory services, with a focus on delivering in-depth insights through comprehensive reports that support informed strategic decision-making.

Contact Us:

Email: sales@straitsresearch.com