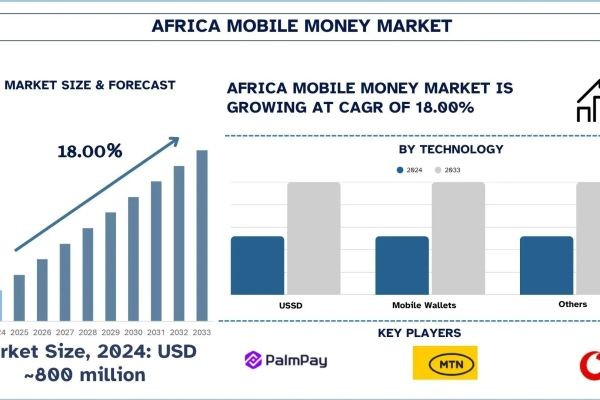

According to UnivDatos, Cheaper smartphones + wider 4G/5G reach are pulling more people into mobile wallets, and Policy tailwinds for inclusion and faster payments are some of the key factors supporting the market rise. As per their “Africa Mobile Money Market” report, the Africa market was valued at USD 800 million in 2024, growing at a CAGR of about 18.00% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The mobile money market in Africa is passing through a momentous change that is shaping the shift in the financial ecosystem in the various countries of Africa. Digital wallets are rapidly becoming financial super-apps, which have unified payments, savings, lending, insurance, and e-commerce services and present them all as a single platform. With these innovations, financial inclusion is growing, consumers are being empowered, and entrepreneurship in urban and rural regions is also thriving. Telecom operators are emerging as big fintechs, and investors are investing in scalable, technology-based solutions. As part of the growing adoption of smartphones, cheap internet access, and enabling regulation, Africa is becoming a world center of mobile financial innovation- ensuring an increasingly connected, inclusive, and cashless economy.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/africa-mobile-money-market?popup=report-enquiry

Wallets are evolving into financial super-apps:

The digital wallet is changing the mobile money market in Africa radically as it is turning into a financial super-app. These services are not only increasing the number of transactions but also providing complete services like payments, lending, insurance, and e-commerce that allow its users a smooth financial experience. This revolution is transforming the nature of interactions between individuals and businesses, and financial inclusion opens new possibilities. These platforms are reaching underserved populations across the continent by leveraging mobile-first technologies, inexpensive smartphones, and expanding network infrastructure. Consumer empowerment is not the only reason why the emergence of mobile money super-apps is contributing to economic growth, entrepreneurship, and cross-border trade. Since the sector is still evolving, it is likely to change the direction of the African financial landscape, as it can make it more open and reachable.

Latest Trends in the Africa Mobile Money Market

Fintech is a core earnings engine for telcos:

Fintech is a growing trend as a key revenue generator for telecom companies (telcos), particularly in Africa. This is because mobile financial solutions are now a major source of revenue obtained by the telcos as they diversify their services to supplement the traditional telecom services. Mobile money, digital wallets, and payment systems are becoming more and more part of telco platforms, and they are therefore able to capitalize on the increasing interest in financial inclusion.

MTN, Safaricom, and Airtel are telecom companies that are taking advantage of the large number of mobile subscribers and are offering not only communication services but also payment services, loans, insurance, etc. This shift makes telcos the main actors in the digital financial environment, where they will extend their reach and enhance customer loyalty. As mobile-first economies emerge and mobile penetration increases, the provision of fintech services has become the primary source of business value for telcos, generating new sources of revenue and contributing to faster economic empowerment on the continent.

Key Investment Trends:

The mobile money market in Africa remains a popular place to invest, as the rate of smartphone adoption, growing internet penetration, and an increasing need to access financial services have been steadily increasing. Investors are focusing on the fintech startups that provide smooth payment solutions and money transfer across borders, and digital lending to customers. Various other countries, such as Kenya, Nigeria, and Ghana, are at the forefront of innovation, which is aided by a friendly regulatory environment as well as a strategic alliance between telecommunication services and banking companies. Scalable platforms that combine mobile wallets with e-commerce and microfinance services are becoming a target of venture capital and other private equity funds. This tendency indicates the process of turning Africa into a cashless economy and points out the opportunities for the continent to develop on the basis of fintech.

Recently, many of the key companies have announced their investments in the African mobile money, which would be crucial for the market expansion in the coming years. For instance, in 2025, Norfund (Norwegian Investment Fund) announced to invest USD 134.9 million (Euro 1117 million) in the Wave mobile money growth in Africa.

Click here to view the Report Description & TOC https://univdatos.com/reports/africa-mobile-money-market

Country Market Growth

The mobile money market in Egypt is growing satisfactorily as smartphone usage increases, government digitalization initiatives, and the processes of financial inclusion. Telecom operators and fintech startups are growing wallet services, a system that facilitates payments, transfers, and savings via mobile systems. The regulatory environment by the Central Bank of Egypt remains trusting and innovative to encourage both domestic and foreign investment. Despite cash still being the leading payment method, the changing tastes of consumers and acceptance by merchants are driving the use of digital payments faster. Egypt is also establishing itself as a regional powerhouse of mobile financial services in North Africa, with a young and technology-oriented population and a favorable business environment.

“Fintech Fuels Africa’s Digital Money Renaissance”

The mobile money revolution in Africa is redefining the future of the finance industry through innovation, accessibility, and investment. With the growth of fintech super-apps, telecoms are undergoing transformation, and investors are pouring capital into the continent, which is developing a strong digital economy. It is not only a financial move, but it is driving empowerment, inclusion, and sustainable development throughout Africa.

Related Report:-

Brazil Digital Payments Market: Current Analysis and Forecast (2025-2033)

Southeast Asia E-Commerce Market: Current Analysis and Forecast (2025-2033)

Neo Banking Market: Current Analysis and Forecast (2023-2030)

MENA Fintech Market: Current Analysis and Forecast (2023-2030)

MasterCard Market: Current Analysis and Forecast (2022-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/