The atrial fibrillation (AF) device market represents one of the most dynamic segments within the cardiovascular medical technology industry, driven by the escalating global prevalence of arrhythmias and the increasing need for effective long-term management solutions. Atrial fibrillation is characterized by irregular electrical activity in the heart’s upper chambers, leading to impaired blood flow, elevated stroke risk, and reduced cardiac efficiency. As healthcare systems confront the growing burden of chronic cardiovascular diseases, device-based approaches for diagnosing, monitoring, and treating AF are gaining prominence, shaping the market’s overall trajectory.

A core aspect of market analysis is the expanding patient population. Aging demographics worldwide are a major contributor, as the incidence of atrial fibrillation rises significantly with age. Improvements in life expectancy mean more individuals are living long enough to develop arrhythmias associated with structural and degenerative changes in the heart. In addition, the increasing prevalence of comorbid conditions such as hypertension, obesity, diabetes, and sleep apnea is amplifying AF risk across both developed and emerging economies. This expanding pool of patients is generating sustained demand for a wide range of devices, from diagnostic monitors to interventional treatment systems.

Technological advancement is another defining factor influencing market dynamics. Innovations in catheter ablation technology have transformed the treatment landscape, offering a minimally invasive alternative to long-term pharmacological therapy. Modern ablation systems incorporate features such as contact-force sensing, enhanced energy delivery control, and real-time imaging integration, enabling physicians to perform more precise procedures with improved safety profiles. The introduction of new energy modalities, including cryoablation and pulsed field ablation, is further diversifying treatment options and driving competition among manufacturers.

Diagnostic and monitoring devices constitute a rapidly growing segment within the AF device market. Because atrial fibrillation can be intermittent and asymptomatic, continuous or long-term monitoring is often necessary for accurate detection. Wearable electrocardiogram (ECG) devices, mobile telemetry systems, and implantable loop recorders are increasingly used to capture irregular heart rhythms over extended periods. Advances in miniaturization, battery life, and wireless connectivity have enhanced patient comfort and compliance, making these devices suitable for routine clinical use as well as preventive screening.

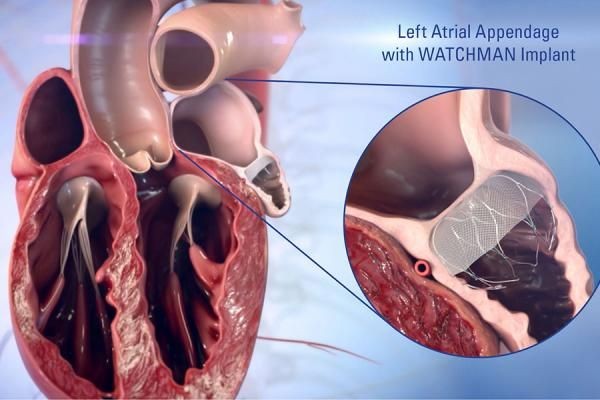

Another significant element of market analysis is the rising importance of stroke prevention strategies. AF is a major risk factor for ischemic stroke, and managing this risk is a central goal of treatment. While anticoagulant medications remain standard therapy, device-based alternatives such as left atrial appendage closure (LAAC) systems are gaining traction. These devices mechanically seal the appendage where blood clots commonly form, reducing stroke risk without the need for lifelong medication. Improvements in implantation techniques and device design have broadened the eligible patient population, supporting market growth.

Economic considerations also shape the competitive landscape. AF devices often involve high upfront costs related to equipment, procedural infrastructure, and physician training. However, they can deliver substantial long-term savings by preventing costly complications such as stroke, heart failure exacerbations, and repeated hospital admissions. Health economic analyses increasingly demonstrate the value of early intervention, influencing reimbursement decisions and procurement strategies. In regions with supportive reimbursement frameworks, adoption rates tend to be higher, encouraging manufacturers to focus on these markets while also exploring cost-reduction strategies for price-sensitive regions.

Healthcare infrastructure and specialist availability play a crucial role in determining market penetration. Advanced AF interventions, particularly catheter ablation, require specialized electrophysiology laboratories and highly trained clinicians. Developed regions with established cardiac care networks lead in procedure volumes, but emerging economies are rapidly expanding their capabilities. Investments in hospital modernization, physician training programs, and telemedicine are enabling broader access to advanced arrhythmia care, contributing to global market expansion.

Regulatory pathways and clinical evidence are additional factors influencing device adoption. Stringent approval processes ensure safety and efficacy but can extend development timelines and increase costs for manufacturers. At the same time, robust clinical trial data demonstrating improved patient outcomes strengthens physician confidence and encourages guideline inclusion. As more long-term studies confirm the benefits of device-based therapies, particularly for early intervention, utilization is expected to increase.

Patient preferences and quality-of-life considerations are increasingly important in market analysis. Many individuals with atrial fibrillation experience symptoms such as palpitations, fatigue, and reduced exercise tolerance, which can significantly impair daily functioning. Device-based treatments that offer durable symptom relief without the side effects associated with medications are highly valued. Additionally, the convenience of remote monitoring and reduced need for frequent hospital visits aligns with modern expectations for patient-centered care.

Competitive dynamics within the market are characterized by ongoing innovation and strategic partnerships. Major medical device companies are investing heavily in research and development to introduce next-generation products with enhanced safety, usability, and clinical effectiveness. Collaborations between device manufacturers, software developers, and healthcare providers are facilitating the integration of digital technologies, including artificial intelligence for data analysis and predictive modeling.

Geographically, the market exhibits varying growth patterns. North America and Western Europe maintain leadership due to high awareness, advanced healthcare systems, and favorable reimbursement policies. Meanwhile, Asia-Pacific, Latin America, and parts of the Middle East are emerging as high-growth regions, driven by increasing cardiovascular disease burden and improving access to specialized care. Government initiatives aimed at strengthening healthcare infrastructure and expanding insurance coverage are further supporting adoption in these areas.

In conclusion, the atrial fibrillation device market is shaped by a complex interplay of demographic trends, technological progress, economic factors, and evolving clinical practices. The shift toward minimally invasive procedures, continuous monitoring, and personalized treatment strategies is redefining how atrial fibrillation is managed worldwide. As the global population ages and cardiovascular risk factors remain prevalent, demand for effective device-based solutions will continue to rise. Companies that successfully combine innovation with affordability and accessibility are likely to lead the market and play a crucial role in improving outcomes for patients living with this widespread cardiac condition.