Expert Market Research Highlights Cable Assembly Market Size and Growth Potential

Backed by insights from Expert Market Research, the cable assembly market is undergoing a transformative phase marked by robust growth and expansive industrial application. As demand for reliable connectivity surges across sectors like automotive, aerospace, and telecom, the market’s size is witnessing significant escalation. Rapid digitalization and automation are key catalysts propelling the industry forward, alongside rising requirements for high-speed data transmission. With technological advancements improving cable assembly precision and functionality, companies are increasingly investing in innovative solutions. This dynamic evolution highlights not just the market’s growing footprint but also its critical role in supporting the future of global connectivity.

Overview of the Cable Assembly Market

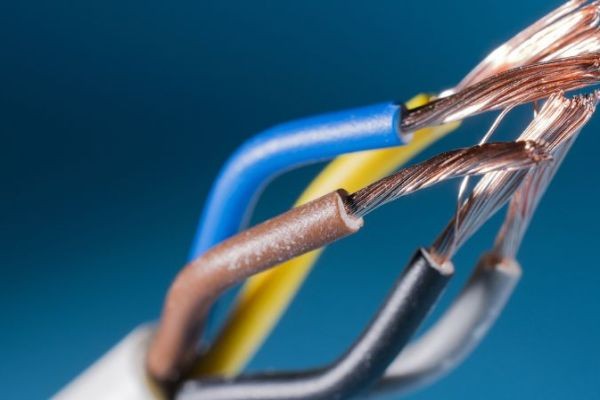

The cable assembly market plays a critical role in powering and connecting modern electronic systems. Cable assemblies are sets of wires or cables arranged into a single unit to transmit power or information efficiently and securely. These assemblies are essential across numerous industries including automotive, telecommunications, consumer electronics, industrial automation, medical devices, aerospace, and defense. The growth of smart devices, Industry 4.0, and IoT technologies has further boosted demand for reliable and complex cable assemblies. With innovations in fiber optics, coaxial systems, and advanced shielding technologies, manufacturers are delivering higher-performance and more durable solutions. The global market is being shaped by evolving industry requirements, increased digital infrastructure development, and a consistent push towards miniaturization and energy efficiency in devices.

Market Size

In 2024, the global cable assembly market size was valued at USD 179.86 billion, underlining its vast and diverse applications across multiple sectors. The market's exponential expansion is being fueled by the proliferation of electronic devices, rising demand for high-speed internet and data communication, and innovations in automotive electronics and industrial automation. With increasing infrastructure investments in developing regions and technological advancements in developed markets, the cable assembly sector is experiencing strong traction. As data-centric technologies gain momentum, there is a notable shift toward high-performance, customized cable assemblies. This strong market size indicates a growing reliance on interconnectivity components, which are foundational to both emerging technologies and traditional applications alike.

Market Trends

Emerging trends in the cable assembly market reflect rapid advancements in smart technologies, including 5G infrastructure, electric vehicles, and industrial IoT. One of the key trends is the growing demand for fiber optic cables, which offer enhanced bandwidth and faster transmission speeds, supporting data-intensive operations. In addition, miniaturized and custom cable assemblies are gaining traction in the medical device and aerospace sectors, where space constraints and durability are paramount. The adoption of shielded assemblies is also growing due to increased emphasis on data security and electromagnetic interference (EMI) protection. Moreover, the trend of outsourcing cable assembly production to third-party manufacturers is rising, especially among small to mid-size enterprises seeking cost efficiency and flexibility.

Market Opportunities and Challenges

As industries continue to digitize, the need for fast, secure, and reliable cable connections intensifies. Moreover, demand for custom cable assemblies is on the rise, enabling manufacturers to cater to specific industry requirements. However, the market is not without challenges. High raw material costs, complex regulatory environments, and the risk of supply chain disruptions pose potential obstacles. Additionally, rapid technological changes require constant innovation, making it imperative for players to stay ahead in R&D investments. Balancing customization with large-scale production remains a key challenge for industry players.

Market Segmentation

Breakup by Cable Type

- Coaxial Cables

- Twisted Pair Cables

- Fiber Optic Cables

- Flat Ribbon Cables

- Rectangular

- RF

- Circular

- Others

Breakup by Application

- Data Communication

- Power Transmission

- Industrial Automation

- Medical Devices

Breakup by Connector Type

- DB Connectors

- USB Connectors

- HDMI Connectors

- RJ45 Connectors

Breakup by Shielding

- Unshielded

- Shielded

Breakup by Assembly

- Custom-Assembled

- Pre-Assembled

Breakup by End Use

- Automotive

- Consumer Electronics

- Telecom and Datacom

- Industrial

- Aerospace and Defence

- Others

Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Growth

The cable assembly market is expected to undergo significant growth in the coming years, driven by the rapid expansion of data centers, high-speed internet infrastructure, and the increasing adoption of electric and autonomous vehicles. The development of smart cities and industry-specific automation solutions continues to create new use cases for complex cable assemblies. With a CAGR of 6.30% projected during 2025–2034, the market’s growth trajectory highlights the increasing integration of cable assemblies in both traditional industries and emerging tech sectors. In addition, as sustainability and energy-efficiency become industry standards, there is a growing demand for advanced cable systems that support green energy solutions and reduce power loss. The surge in smart consumer electronics and industrial robotics will further catalyze market expansion globally.

Market Forecast

The global cable assembly market is forecast to reach a value of USD 331.33 billion by 2034, nearly doubling from its 2024 size of USD 179.86 billion. This projected growth represents strong investor confidence and increasing end-user demand across regions. Asia Pacific is expected to lead the market share due to its thriving electronics manufacturing sector and infrastructure projects. North America and Europe will continue to adopt advanced cable technologies to support industrial automation and smart transportation. Meanwhile, emerging economies in Latin America and the Middle East are becoming key areas of growth, supported by rising urbanization and digitalization. As technological advancements accelerate, especially in fiber optics, IoT, and wireless connectivity, the demand for high-quality and durable cable assemblies will continue to rise, ensuring sustained market momentum throughout the forecast period.

Competitor Analysis

The cable assembly market is highly competitive, with several global players offering a wide range of standard and custom cable solutions. Key players include:

- 3M Company [NYSE: MMM] – Global innovation leader in interconnect solutions for multiple industries.

- Amphenol Corporation – Offers a wide array of cable assemblies for telecom, automotive, and aerospace sectors.

- Corning Inc. – Specializes in fiber optic assemblies with high-performance solutions.

- Molex Incorporated – Delivers customized cable assemblies focused on data centers and automotive.

- Aptiv Plc – Develops advanced vehicle connectivity solutions in cable and sensor assemblies.

- Tyco Electronics – Renowned for durable and efficient industrial cable assembly products.

- Hirose Electric Co., Ltd. – Manufactures high-speed data connectors and assembly components.

- Delphi Technologies – Focuses on automotive and mobility cable solutions.

- JST Manufacturing Co., Ltd. – Produces compact and high-density interconnect solutions.

- Sumitomo Electric Industries, Ltd. – Leading manufacturer of fiber optic cable assemblies.

- Yazaki Corporation – Supplies automotive wire harnesses and cable assemblies globally.

- Furukawa Electric Co., Ltd. – Specializes in advanced fiber optic and telecom cable assemblies.