Market Overview:

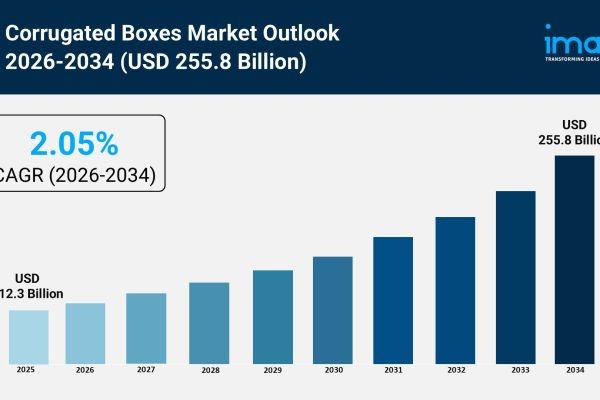

The corrugated boxes market is experiencing rapid growth, driven by exponential expansion of global e-commerce, strict sustainability mandates and plastic substitution, and innovations in digital printing and brand customization. According to IMARC Group’s latest research publication, “Corrugated Boxes Market Size, Share, Trends and Forecast by Material Used, End Use, and Region, 2026-2034”, The global corrugated boxes market size was valued at USD 212.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 255.8 Billion by 2034, exhibiting a CAGR of 2.05% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/prefeasibility-report-corrugated-box-manufacturing-plant/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Corrugated Boxes Market

- Exponential Expansion of Global E-commerce

The surge in online retail remains the primary engine for the corrugated boxes market, as digital storefronts require robust secondary packaging to ensure the safe transit of goods. Current industry data reveals that the e-commerce sector has reached a staggering valuation, with global business-to-business sales alone projected to hit $36 trillion this year. Unlike traditional brick-and-mortar retail, the e-commerce supply chain is significantly more intensive, often utilizing seven times the amount of corrugated material per dollar spent. Major retailers like Amazon and Walmart have made massive investments in fulfillment infrastructure, which directly translates to a higher volume of parcel shipments. To meet this demand, manufacturers are increasing the production of slotted boxes and protective liners, as these materials offer a superior strength-to-weight ratio. This reliance on corrugated solutions is further cemented by the fact that over 50% of all e-commerce packaging currently consists of corrugated board.

- Strict Sustainability Mandates and Plastic Substitution

Environmental regulations are fundamentally reshaping the packaging landscape, driving a widespread transition from single-use plastics to fiber-based alternatives. This year marks a critical turning point as the United Kingdom enters its first full year under the Packaging Extended Producer Responsibility scheme, while the European Union implements more uniform requirements through the Packaging and Packaging Waste Regulation. These initiatives mandate higher levels of recycled content and improved recyclability, positioning corrugated boxes—which already boast a recycling rate exceeding 93% for old corrugated containers—as the preferred choice for brands. Consequently, companies in the food, beverage, and personal care sectors are actively replacing plastic shrink wraps and foam inserts with paper-engineered corrugated solutions. This strategic shift is supported by consumer behavior, as approximately 77% of online shoppers now explicitly prefer eco-friendly packaging, and nearly 60% are willing to pay a premium for verified sustainable options.

- Innovations in Digital Printing and Brand Customization

The transformation of the corrugated box from a simple shipping container into a sophisticated marketing tool is a major driver of market value. Advanced digital printing technologies now allow businesses to execute high-quality, short-run customizations that were previously cost-prohibitive. For instance, the brewery industry is utilizing single-pass water-based presses to create region-specific or promotional packaging without compromising brand consistency. Current market insights indicate that 64% of consumers try new products specifically because the packaging catches their attention, while 41% repeat purchases based on design preference. Companies like Atlantic Packaging are leading this trend by integrating digital printing with traditional pre-printing to provide brands with the flexibility needed for rapid replenishment and "unboxing" experiences. This capability not only enhances brand loyalty but also allows for the inclusion of variable data, such as unique QR codes, which further integrates the physical package into the brand's digital ecosystem.

Key Trends in the Corrugated Boxes Market

- Integration of Smart Packaging and IoT Traceability

Corrugated packaging is evolving into an interactive data platform through the widespread adoption of IoT sensors, QR codes, and Near Field Communication (NFC) chips. In 2026, "connected packaging" has moved from experimental pilots to a mainstream logistical necessity, particularly in the pharmaceutical and food industries. These smart boxes enable real-time monitoring of environmental conditions such as temperature, humidity, and shock during transit, which is vital for maintaining the integrity of the cold chain. Beyond logistics, these tools serve as a "digital bridge" for consumers; by scanning a box, a buyer can access a product’s lifecycle data, authenticity certificates, or interactive assembly guides. Current applications include luxury brands embedding cryptographic signatures within corrugated walls to combat counterfeiting. This trend effectively turns a static cardboard container into a dynamic information system, providing transparency that satisfies both regulatory transparency requirements and the modern consumer’s demand for product origin data.

- Adoption of On-Demand and Right-Sizing Automation

A significant shift is occurring toward "right-sizing" technology, where automated machinery creates custom-fit corrugated boxes in real-time based on the specific dimensions of a product. This trend addresses the dual challenges of material waste and "dim-weight" shipping charges, which can account for a substantial portion of logistics costs. Leading fulfillment centers are now deploying AI-driven box-making machines that automatically adjust pressure and cutting paths to produce the smallest possible protective shell for an item. This innovation eliminates the need for excessive plastic void-fillers and reduces the carbon footprint of each shipment by optimizing pallet space. Real-world applications show that AI-assisted manufacturing can reduce overall production waste by up to 20% while cutting lead times for custom orders by 25%. By aligning box size exactly with the contents, companies are achieving a "zero-waste" approach that resonates with the circular economy goals currently prioritized by global retailers.

- Development of High-Performance, Lightweight Materials

The industry is experiencing a material science revolution focused on "lightweighting," which involves creating thinner corrugated boards that maintain or exceed the structural strength of traditional heavy grades. This is being achieved through the use of nano-fiber reinforced papers and hybrid fluting combinations that provide exceptional rigidity without the added bulk. For example, some manufacturers are now utilizing "layer-on-demand" technology to customize the thickness of the box walls specifically for fragile or high-value articles. This trend is particularly relevant in the Asia-Pacific region, where last-mile delivery costs can exceed 30% of total logistics expenses, making every gram of weight reduction financially significant. These high-performance designs often incorporate biodegradable coatings to provide moisture resistance, effectively replacing plastic linings. The result is a new generation of "technical" corrugated packaging that is easier to handle, cheaper to transport, and fully compatible with existing paper recycling streams.

Our report provides a deep dive into the corrugated boxes market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Leading Companies Operating in the Global Corrugated Boxes Industry:

- International Paper Company

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- WestRock Company

- Smurfit Kappa Group plc

- Lee and Man Paper Manufacturing Ltd.

Corrugated Boxes Market Report Segmentation:

By Material Used:

- Recycled Corrugates

- Virgin Corrugates

Recycled corrugates represent the largest segment as they help conserve natural resources, primarily by reducing the need for virgin fiber from trees.

By End Use:

- Food Products and Beverages

- Paper Products

- Electrical and Electronic Goods

- Personal Care and Household Goods

- Chemicals

- Glassware and Ceramics

- Textile Goods

- Others

Food products and beverages account for the majority of the market share due to the rising need for effective packaging solutions.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific's dominance in the corrugated boxes market is attributed to the increasing eco-consciousness among the masses.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302