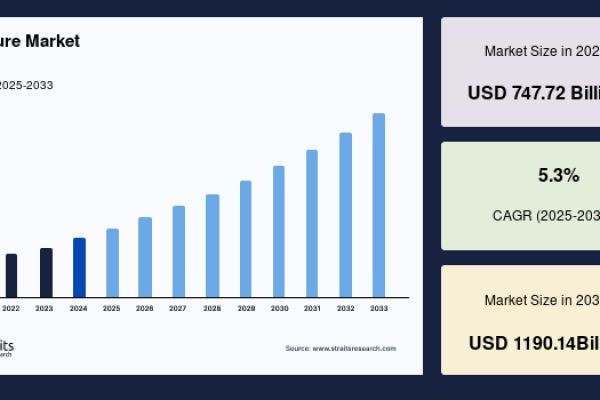

The global furniture industry represents a critical component of the residential and commercial construction ecosystem, encompassing a wide range of products designed for comfort, functionality, and aesthetics. Furniture plays a vital role in shaping living spaces, workplaces, hospitality environments, and institutional infrastructure. According to Straits Research, the global furniture market size is valued at USD 747.72 billion in 2024 and is projected to reach USD 1,190.14 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2033. This steady expansion reflects rising urbanization, increased residential construction, evolving consumer lifestyles, and growing demand for ergonomic and sustainable furniture solutions across both developed and emerging economies.

Request Sample @

https://straitsresearch.com/report/furniture-market/request-sample

Furniture Market Operational Factors

Multiple operational factors are influencing the growth and transformation of the global furniture market. One of the primary drivers is rapid urbanization and housing development, particularly in Asia-Pacific and parts of the Middle East, where expanding middle-class populations are investing heavily in home furnishings. The rise of smaller urban living spaces has also increased demand for modular, multifunctional, and space-saving furniture designs.

Another key operational factor is the shift toward sustainability and eco-friendly materials. Manufacturers are increasingly adopting responsibly sourced wood, recycled metals, and low-emission finishes to comply with environmental regulations and meet consumer expectations. Supply chain optimization, automation in manufacturing, and digitalization of sales channels are further reshaping industry operations. E-commerce platforms, augmented reality (AR)-based visualization tools, and direct-to-consumer (DTC) business models are enhancing customer experience while reducing distribution costs.

Additionally, the growing adoption of ergonomic furniture in workplaces and home offices—driven by hybrid and remote working trends—continues to support market expansion. Commercial demand from offices, healthcare facilities, educational institutions, and hospitality sectors remains a significant contributor to overall revenue growth.

Top Players of the Furniture Market

The global furniture market is moderately fragmented, with the presence of multinational corporations, regional manufacturers, and niche design-focused brands. Leading players focus on innovation, sustainable sourcing, global expansion, and omnichannel retail strategies.

- Steelcase Inc.

- Ashley Home Stores Ltd

- Inter IKEA Systems B.V.

- Okamura Corporation

- Kohler Co.

- Herman Miller Inc.

- Humanscale

- La-Z-Boy Incorporated

- McCarthy Group Ltd.

- Cascata Capital

These companies are actively investing in product design, smart furniture solutions, and advanced manufacturing technologies while expanding their presence across high-growth regions through partnerships, acquisitions, and new retail formats.

Furniture Market Categorization

1. By Product Type

- Beds

- Tables and Desks

- Sofa and Couch

- Chairs and Stools

- Cabinets and Shelves

- Others

2. By Material

- Metal

- Wood

- Plastic

- Glass

- Others

3. By End-User

- Residential

- Commercial

Residential furniture continues to dominate market demand due to increasing home ownership, renovation activities, and rising interest in interior design. Meanwhile, the commercial segment is expanding steadily, supported by corporate office development, hospitality projects, and institutional infrastructure investments.

Get Detailed Segmentation @

https://straitsresearch.com/report/furniture-market/segmentation

Geographic Overview

The global furniture market exhibits strong regional variation in terms of demand patterns, material preferences, and design trends.

North America remains a mature yet high-value market, led by the United States and Canada. Demand is driven by residential remodeling, ergonomic office furniture adoption, and premium lifestyle products. Sustainability and smart furniture integration are key trends shaping consumer purchasing decisions in this region.

Europe is characterized by strong emphasis on design, sustainability, and regulatory compliance. Countries such as Germany, Italy, France, and the United Kingdom dominate the regional market. European consumers show a growing preference for eco-certified furniture, minimalist aesthetics, and high-quality craftsmanship.

Asia-Pacific represents the fastest-growing region, supported by rapid urbanization, rising disposable incomes, and expanding real estate development. China, India, Japan, and Southeast Asian countries are major contributors. Cost-effective manufacturing, increasing domestic consumption, and export-oriented production make this region a global furniture manufacturing hub.

Latin America and the Middle East & Africa (MEA) are emerging markets with increasing infrastructure development and hospitality investments. Brazil, Mexico, the UAE, and Saudi Arabia are key growth countries, supported by urban housing projects, tourism expansion, and commercial construction.

Key Unit Economics for Businesses and Startups

Understanding unit economics is critical for furniture manufacturers, retailers, and startups entering the market. Major cost components include raw materials (wood, metal, upholstery), labor, logistics, warehousing, and marketing. Transportation and last-mile delivery costs are particularly significant due to the bulky nature of furniture products.

Margins vary widely depending on product category, material selection, and sales channel. Direct-to-consumer and online-first brands typically achieve higher gross margins by eliminating intermediaries, although they incur higher logistics and customer acquisition costs. Custom and premium furniture segments offer stronger margins but require greater upfront investment in design and craftsmanship.

For startups, success increasingly depends on lean inventory models, modular product designs, sustainable sourcing, and digital marketing efficiency. Leveraging data analytics for demand forecasting and customer personalization can significantly improve profitability and scalability.

Why Straits Research?

Straits Research is a trusted provider of actionable market intelligence, offering in-depth industry analysis, robust forecasting models, and customized research solutions. The firm combines qualitative insights with quantitative data to support strategic decision-making across industries. With a strong focus on accuracy, transparency, and client-specific requirements, Straits Research helps businesses identify growth opportunities, assess competitive landscapes, and navigate evolving market dynamics with confidence.

Have Any Query? Ask Our Experts @

https://straitsresearch.com/buy-now/furniture-market