Health Insurance Market Overview:

New York, United States – Straits Research, a leading provider of business intelligence, analytics, and advisory services, has published its latest comprehensive report on the Health Insurance Market, highlighting strong long-term growth driven by increasing healthcare expenditure, rising prevalence of chronic diseases, expanding insurance coverage, and continuous innovation in policy design and distribution models. The report provides a detailed assessment of market size, growth catalysts, competitive dynamics, emerging prospects, and regional performance, offering valuable insights for insurers, healthcare providers, investors, and policymakers.

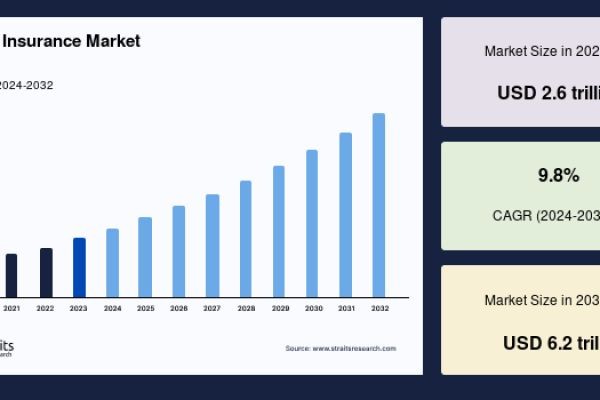

Health Insurance Market Size

According to Straits Research, the global health insurance market size is valued at USD 2.6 trillion in 2023 and is projected to reach USD 6.2 trillion by 2032, growing at a CAGR of 9.8% from 2024 to 2032.

Health Insurance Market Overview

Health insurance serves as a critical financial mechanism that mitigates the economic burden associated with medical care, hospitalization, diagnostics, and long-term treatment. With rising healthcare costs worldwide, health insurance has transitioned from an optional financial product to an essential component of social and economic stability. Governments, private insurers, and employers are increasingly collaborating to expand coverage penetration, improve affordability, and enhance access to quality healthcare services.

The market is undergoing structural transformation fueled by digital health platforms, data-driven underwriting, value-based care models, and customized insurance products tailored to diverse demographic segments. These shifts are reshaping how insurers engage with policyholders and manage risk.

Health Insurance Market Catalysts for Expansion

Several key factors are accelerating growth in the global health insurance market:

- Rising Healthcare Expenditure: Escalating costs of medical treatments, diagnostics, and hospitalization are increasing the demand for comprehensive health insurance coverage.

- Growing Prevalence of Chronic Diseases: The increasing incidence of diabetes, cardiovascular diseases, cancer, and respiratory disorders is driving long-term insurance adoption.

- Aging Global Population: Rapidly aging populations, particularly in developed economies, are boosting demand for senior-focused health insurance products.

- Government Initiatives and Mandates: Public health insurance schemes, mandatory coverage policies, and subsidies are expanding insurance penetration in emerging and developed markets.

- Digitalization of Insurance Services: The integration of AI, big data analytics, and mobile platforms is enhancing policy distribution, claims processing, and customer engagement.

Request Sample @

https://straitsresearch.com/report/health-insurance-market/request-sample

Top Performing Companies in the Health Insurance Market

The global health insurance landscape is highly competitive, characterized by the presence of multinational insurers and strong regional players focusing on service differentiation, pricing strategies, and digital innovation.

- United Healthcare

- Aetna

- Anthem, Inc.

- Aviva

- Allianz

- Centene

- Cigna

- CVS Health Corporation

- Humana

- Kaiser Foundation

- Bupa

- Bajaj Allianz General Insurance Company

- AXA

- Aditya Birla Capital Ltd.

- Now Health International

These companies are actively investing in digital platforms, expanding provider networks, and launching innovative coverage plans to strengthen their market positions.

Health Insurance Market Emerging Prospects

The market is witnessing several emerging opportunities that are expected to shape its future trajectory. Personalized and modular insurance products are gaining traction as consumers seek flexible coverage aligned with their specific health risks and financial capabilities. Additionally, the rise of telemedicine and remote patient monitoring is encouraging insurers to integrate digital health services into insurance plans.

Emerging economies present significant growth potential due to increasing awareness of health insurance benefits, expanding middle-class populations, and supportive regulatory reforms. Microinsurance and low-cost health plans are also gaining momentum in price-sensitive markets, enabling broader inclusion.

Health Insurance Market Industry Movements

Industry movements indicate a shift toward consolidation and strategic partnerships. Mergers and acquisitions are enabling insurers to expand geographic reach, diversify product portfolios, and achieve operational efficiencies. Collaborations between insurers, healthcare providers, and technology firms are fostering integrated care ecosystems that emphasize preventive care and cost optimization.

Additionally, insurers are increasingly adopting value-based reimbursement models that prioritize patient outcomes over service volume, aligning incentives across the healthcare value chain.

Health Insurance Market Segmental Analysis

The Health Insurance Market is segmented across multiple dimensions to provide a comprehensive understanding of demand patterns.

- By Type

- Disease Insurance

- Medical Insurance

Medical insurance dominates the market due to its broad coverage scope, while disease-specific insurance is gaining popularity for targeted risk protection.

- By Coverage

- Preferred Provider Organizations (PPOS)

- Point of Service (POS)

- Health Maintenance Organization (HMOS)

- Exclusive Provider Organizations (EPOS)

PPOS and HMOS continue to account for a significant share due to their cost efficiency and structured care networks.

- By Age Group

- Senior Citizens

- Adult

- Minors

Senior citizens represent a rapidly growing segment due to higher healthcare utilization rates and increasing life expectancy.

- By Time Period

- Life-Time Coverage

- Term Insurance

Lifetime coverage plans are gaining traction as consumers seek long-term financial security against healthcare inflation.

- By End User

- Group

- Individuals

Group insurance remains dominant, supported by employer-sponsored health plans, while individual policies are witnessing steady growth.

Get Detailed Segmentation @

https://straitsresearch.com/report/health-insurance-market/segmentation

Health Insurance Market Geographic Analysis

North America holds a leading position in the global health insurance market, supported by advanced healthcare infrastructure, high insurance penetration, and strong presence of major insurers. Europe follows closely, driven by universal healthcare systems complemented by private insurance offerings. The Asia-Pacific region is expected to witness the fastest growth, fueled by large populations, rising healthcare awareness, and government-led insurance programs in countries such as China and India.

Health Insurance Market Data Insights

Data insights from the report indicate a steady increase in policy renewals, growing adoption of digital claims processing, and rising customer preference for value-added services such as wellness programs and preventive care benefits. These trends underscore the evolving expectations of insured individuals and the need for insurers to innovate continuously.

Future Outlook

The global health insurance market is set to experience sustained growth as healthcare access, affordability, and quality remain central priorities for governments and individuals alike. Technological innovation, regulatory support, and demographic shifts will continue to redefine the competitive landscape and unlock new growth avenues.

Have Any Query? Ask Our Experts @

https://straitsresearch.com/buy-now/health-insurance-market

Company Details

Straits Research

Straits Research is a top provider of business intelligence, specializing in research, analytics, and advisory services, with a strong focus on delivering actionable insights through comprehensive market reports across diverse industries.

Contact Us:

Email: sales@straitsresearch.com