The Insurance Telematics Market is rapidly transforming the global insurance landscape by enabling data-driven, usage-based insurance models that enhance risk assessment, pricing accuracy, and customer engagement. Insurance telematics leverages connected devices, GPS, sensors, and advanced analytics to monitor driving behavior, vehicle usage, and risk patterns in real time. Insurers increasingly rely on telematics solutions to offer personalized premiums, reduce fraud, and improve claims management efficiency. This article provides a detailed, SEO-optimized analysis of the global insurance telematics market, strictly based on insights from Straits Research.

Market Size and Growth Outlook

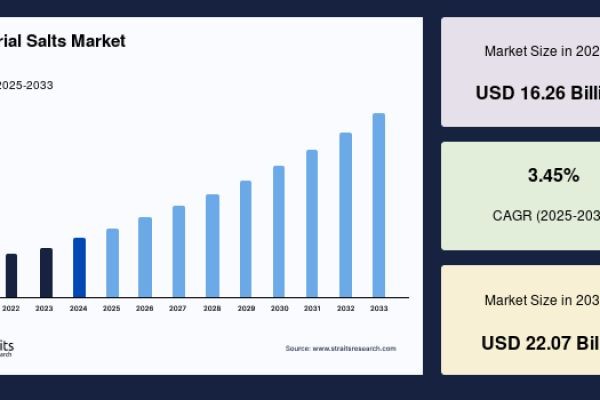

The global insurance telematics market size was valued at USD 3.76 billion in 2023. It is expected to reach USD 17.36 billion in 2032, growing at a CAGR of 18.53% over the forecast period (2024-32).

The strong growth outlook reflects rising adoption of usage-based insurance programs, increasing vehicle connectivity, and insurers’ focus on improving underwriting accuracy and customer retention.

Get Your Sample Report Here: https://straitsresearch.com/report/insurance-telematics-market/request-sample

Buy Report Now: https://straitsresearch.com/buy-now/insurance-telematics-market

Download Full Report: https://straitsresearch.com/report/insurance-telematics-market

Market Drivers

Growing Adoption of Usage-Based Insurance Models

Usage-based insurance models such as pay-as-you-drive and pay-how-you-drive are gaining widespread acceptance among insurers and policyholders. Telematics data enables insurers to assess real driving behavior rather than relying solely on traditional demographic factors, leading to fairer pricing and improved risk segmentation.

Rising Focus on Road Safety and Risk Reduction

Insurance telematics promotes safer driving habits by providing real-time feedback, driver scores, and behavior insights. Insurers benefit from reduced accident frequency and claim costs, while customers gain incentives such as premium discounts for safe driving, driving adoption across personal and commercial insurance segments.

Increasing Penetration of Connected Vehicles

The growing adoption of connected cars equipped with embedded telematics systems is accelerating market growth. Built-in connectivity enables seamless data collection without the need for aftermarket devices, improving data accuracy and expanding telematics adoption among insurers.

Market Challenges

Data Privacy and Regulatory Concerns

Insurance telematics involves continuous collection of sensitive data related to location, driving behavior, and vehicle usage. Ensuring data privacy, cybersecurity, and compliance with data protection regulations remains a critical challenge for insurers and technology providers.

High Initial Implementation and Integration Costs

Deploying telematics infrastructure requires investments in hardware, software platforms, analytics tools, and system integration. Smaller insurers and emerging market players may face cost barriers when implementing comprehensive telematics programs.

Market Segmentation Analysis

By Component

Hardware components such as onboard diagnostic devices, black boxes, and embedded sensors account for a significant share of the market. Software platforms are witnessing rapid growth due to increasing demand for data analytics, risk modeling, and real-time monitoring solutions. Services including installation, data management, and consulting support end-to-end telematics deployments.

By Insurance Type

Auto insurance dominates the insurance telematics market, driven by widespread adoption of usage-based policies and regulatory support for safer driving initiatives. Commercial vehicle insurance is also growing steadily as fleet operators adopt telematics to optimize operations, reduce fuel consumption, and manage driver risk.

By Technology

Embedded telematics systems hold a growing share due to increasing integration by vehicle manufacturers. Smartphone-based telematics solutions are widely adopted due to ease of deployment and lower costs, particularly in personal auto insurance. Aftermarket devices continue to be used where embedded systems are unavailable.

By End User

Insurance companies represent the primary end users, leveraging telematics to improve underwriting, pricing, and claims processes. Fleet operators and mobility service providers also contribute to market growth by adopting telematics-enabled insurance models to reduce operational risks and costs.

Top Players Analysis

-

Allstate

Allstate is a pioneer in insurance telematics, offering usage-based insurance programs that leverage driving behavior data to personalize premiums. Its strong analytics capabilities support large-scale telematics adoption. -

Progressive

Progressive has played a key role in popularizing telematics-based auto insurance through behavior-based pricing models. The company’s focus on innovation and data-driven underwriting strengthens its market position. -

Verisk Analytics

Verisk Analytics provides telematics data and risk assessment solutions that support insurers in pricing, underwriting, and claims management. Its extensive data resources enhance predictive accuracy. -

TomTom

TomTom offers telematics and location-based services used by insurers and fleet operators. Its expertise in navigation and real-time traffic data supports risk analysis and driver behavior monitoring. -

Octo Telematics

Octo Telematics specializes in telematics solutions for insurance and mobility services. The company focuses on advanced analytics and connected vehicle platforms to support usage-based insurance programs globally.

Frequently Asked Questions (FAQs)

What is insurance telematics?

Insurance telematics refers to the use of connected devices and data analytics to monitor driving behavior and vehicle usage for insurance pricing, risk assessment, and claims management.

What is driving the insurance telematics market?

Key drivers include growth of usage-based insurance models, rising connected vehicle adoption, and insurers’ focus on reducing risk and claims costs.

Which insurance segment dominates the market?

Auto insurance dominates due to widespread use of telematics-enabled policies and regulatory support for road safety initiatives.

How fast is the insurance telematics market growing?

The market is expected to grow at a CAGR of 18.53% during the forecast period from 2024 to 2032.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.