The Li-Ion battery electrode coating market plays a critical role in advancing energy storage technologies that power electric vehicles (EVs), consumer electronics, and renewable energy systems. While the sector is experiencing strong demand, it faces significant inhibitors that restrict growth, efficiency, and scalability. Understanding these barriers is essential for stakeholders to navigate challenges and capitalize on opportunities.

1. High Manufacturing Costs and Complexity

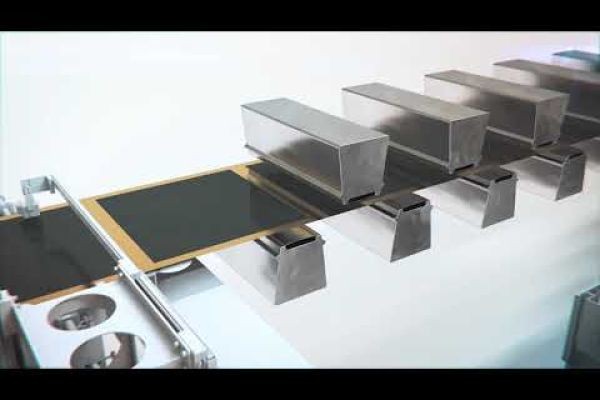

One of the major inhibitors is the cost-intensive nature of electrode coating processes. Advanced coating techniques such as slot-die, gravure, and curtain coating require precise equipment and stringent quality control. The capital investment needed for coating lines, coupled with the cost of specialized solvents and binders, makes large-scale production expensive. Smaller manufacturers, in particular, struggle to compete with established players that have optimized economies of scale. This cost barrier slows down widespread adoption of next-generation coating solutions.

2. Scalability and Process Uniformity Issues

Scalability remains another roadblock. Producing high-performance coatings at laboratory or pilot scales is relatively manageable, but replicating uniformity in large-scale production is far more challenging. Variations in thickness, porosity, or adhesion can compromise battery performance and safety. Since EVs and grid-scale storage require consistent, long-lasting performance, any deviation during the coating process can lead to reduced energy density, lower charging cycles, or even safety hazards. This lack of process uniformity is a major deterrent for rapid commercialization of innovative electrode designs.

3. Raw Material Dependence and Supply Chain Instability

The market also depends heavily on critical raw materials, including lithium, cobalt, nickel, and specialty binders. Disruptions in global supply chains, whether due to geopolitical tensions, mining restrictions, or transportation bottlenecks, pose significant risks. Additionally, fluctuating prices of conductive additives such as carbon nanotubes and graphene make cost planning unpredictable. Manufacturers are forced to either absorb the cost or pass it on to end-users, limiting the affordability and competitiveness of advanced batteries.

4. Environmental and Regulatory Challenges

Environmental concerns act as a further inhibitor. Traditional solvent-based coating methods often rely on toxic chemicals like N-Methyl-2-pyrrolidone (NMP), which pose occupational hazards and require expensive recovery systems. Stricter environmental regulations in regions like Europe and North America add compliance costs and demand shifts toward water-based or dry electrode coating methods. While sustainable alternatives are under development, their slower adoption due to technical immaturity hampers immediate large-scale deployment.

5. Energy Density vs. Safety Trade-offs

Electrode coatings are central to determining the balance between energy density and safety. Manufacturers aiming for higher capacity must adopt thinner coatings, but this increases risks of mechanical degradation and overheating. Conversely, thicker coatings may enhance durability but reduce overall performance. This delicate trade-off makes it difficult for manufacturers to meet consumer expectations for both high performance and safety, particularly in EVs where reliability is non-negotiable.

6. Technological Barriers in Innovation Adoption

While research into dry electrode coatings, nanomaterials, and advanced binders shows promise, scaling these technologies for industrial application remains a bottleneck. Many start-ups and research labs demonstrate breakthroughs in controlled environments, but transferring these methods to high-throughput production systems requires overcoming equipment redesign, workforce retraining, and capital expenditure hurdles. This lag between innovation and commercialization delays market growth.

7. Competition and Pricing Pressures

The highly competitive nature of the battery market also acts as an inhibitor. With EV manufacturers and energy storage providers pushing for lower costs, coating solution providers are under constant pressure to reduce prices without compromising on quality. This results in thin profit margins, discouraging some companies from investing heavily in innovation or expanding capacity.

8. Workforce and Skill Gaps

A less discussed yet critical challenge is the shortage of skilled professionals trained in advanced electrode coating techniques. As coating methods become more sophisticated, companies face difficulties in finding engineers and technicians with the right expertise. This skills gap slows down process optimization and quality assurance, further delaying market maturity.

Conclusion

The Li-Ion Battery Electrode Coating Market is at a pivotal stage of growth, driven by the accelerating demand for EVs, renewable energy storage, and high-performance electronics. Yet, inhibitors such as high manufacturing costs, scalability issues, raw material dependence, and regulatory pressures slow down progress. Overcoming these barriers will require collaborative efforts across the supply chain—ranging from sustainable material sourcing and process innovation to workforce training and regulatory compliance. Stakeholders who can strategically address these inhibitors will be well-positioned to shape the future of the global energy storage landscape.