Planning to buy a property requires clarity around long-term financial commitments, especially monthly mortgage repayments. Many buyers focus on property price alone, without fully understanding how interest rates, loan tenure, and down payments affect affordability. This is where a mortgage calculator in the UAE becomes an essential planning tool, helping buyers convert complex loan structures into clear monthly figures. By using this calculator early in the decision-making process, individuals gain realistic expectations, avoid financial strain, and approach lenders with better preparation and confidence.

What A Mortgage Calculator Shows

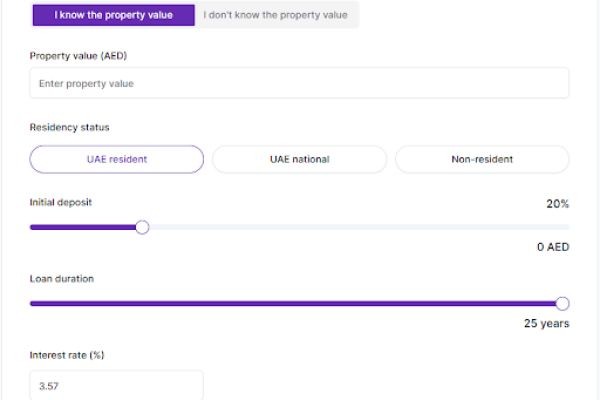

At its core, a mortgage calculator in the UAE estimates monthly repayments based on a few key inputs. These typically include property value, down payment percentage, loan tenure, and interest rate. Once entered, the calculator provides an estimated monthly instalment, offering immediate insight into affordability. While results are indicative rather than final lender approvals, they form a reliable foundation for early-stage financial planning.

How Down Payment Impacts Monthly Payments

The size of your down payment has a direct effect on your loan amount and monthly repayment. Using a mortgage calculator in the UAE, buyers can instantly see how increasing the down payment reduces monthly obligations and total interest paid over time. Even small adjustments upfront can significantly lower long-term financial pressure. This flexibility allows buyers to balance savings with manageable monthly commitments.

Interest Rates And Their Influence Over Time

Interest rates play a major role in determining repayment amounts. Fixed-rate loans offer stability, while variable rates may fluctuate depending on market conditions. A mortgage calculator in the UAE allows buyers to compare scenarios by adjusting interest rates and observing how monthly payments change. This comparison helps buyers assess risk tolerance and choose loan structures aligned with their financial stability and future income expectations.

Understanding Loan Tenure Options

Loan tenure determines how long repayments will continue and how much interest is paid overall. Shorter tenures result in higher monthly payments but lower total interest, while longer tenures reduce the monthly burden but increase total repayment. By adjusting tenure using a mortgage calculator in the UAE, buyers can find a balance between affordability and long-term cost. This insight supports smarter planning around lifestyle expenses and savings goals.

Accounting For Additional Ownership Costs

Monthly mortgage payments are only part of the total cost of owning property. Service charges, maintenance fees, insurance, and utilities must also be considered. While a mortgage calculator in the UAE focuses on loan repayments, it provides a starting point for building a complete monthly housing budget. Factoring in these additional costs prevents unexpected financial pressure after purchase.

Using Calculators To Compare Lenders

Different lenders offer varying interest rates, fees, and loan structures. A mortgage calculator in the UAE helps buyers compare lender offers by entering different terms and observing changes in monthly payments. This comparison empowers buyers to negotiate more effectively and select financing options that align with their budget and long-term plans.

Why Early Calculation Matters

Many buyers begin property searches without understanding their true repayment capacity. Using a mortgage calculator in the UAE early helps narrow property choices to realistic price ranges. This approach saves time, reduces stress, and leads to more confident decision-making. Buyers who plan ahead are less likely to face approval issues or affordability challenges later in the process.

Supporting Smarter Property Decisions

Beyond numbers, calculators encourage disciplined financial thinking. Regular use of a mortgage calculator in the UAE helps buyers reassess affordability as market conditions, interest rates, or personal finances change. This adaptability ensures buyers remain informed and prepared throughout the property journey.

Conclusion

Understanding monthly mortgage payments is a critical step in successful property ownership. By using a mortgage calculator in the UAE, buyers gain clarity, control, and confidence when planning their finances and comparing loan options. At YallaValue, we believe informed calculations lead to smarter decisions, helping our users approach property investments with transparency, confidence, and long-term financial stability.